Bollinger Innovations Strengthens Financial Position with Strategic Capital Restructuring

Summary

Full Article

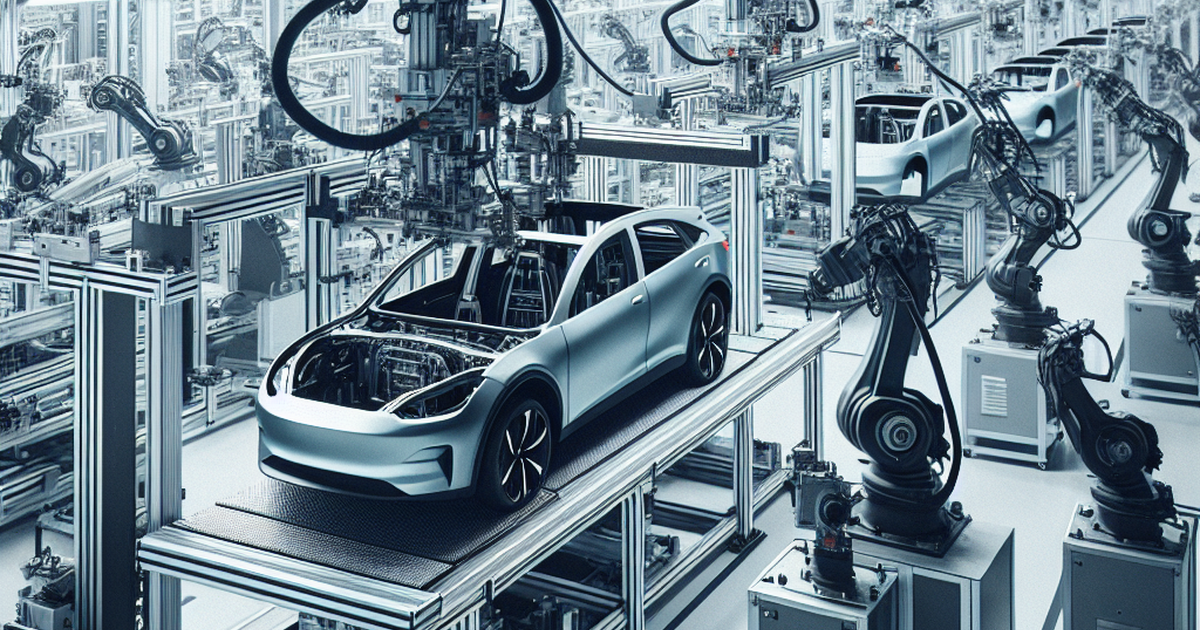

Bollinger Innovations, Inc. (NASDAQ: BINI), a prominent name in the electric vehicle (EV) manufacturing industry, has recently announced a strategic financial restructuring aimed at solidifying its capital structure. The company has successfully eliminated all outstanding warrants and converted $25.3 million in convertible notes into newly created preferred stock. This move, as articulated by CEO and Chairman David Michery, not only streamlines the company's financial framework but also highlights the strong backing from its investors, reinforcing confidence in Bollinger's future endeavors.

The significance of this development cannot be overstated, as it comes at a time when Bollinger Innovations is intensifying its focus on expanding its commercial EV offerings. The company's product lineup, including the ONE Class 1 cargo van, THREE Class 3 cab chassis, and the B4 Class 4 chassis cab, has already set industry benchmarks by meeting U.S. Federal Motor Vehicle Safety Standards, EPA, and CARB certifications. This financial maneuver is a testament to Bollinger's commitment to not only advancing its technological and product capabilities but also ensuring a sustainable and robust financial health to support its ambitious growth plans.

For those interested in delving deeper into the specifics of this announcement, further information is available in the full press release accessible here. This strategic restructuring is a clear indicator of Bollinger Innovations' dedication to maintaining a leading position in the competitive EV market, backed by a solid financial foundation and the unwavering support of its investors.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at InvestorBrandNetwork (IBN)